SpaceX hits $400B valuation in 2025! Discover how Elon Musk’s secret share deal made it America’s top private company. Full breakdown inside.

SpaceX’s $400 Billion Milestone

In mid-2025, SpaceX quietly reached a jaw-dropping valuation of $400 billion, making it the most valuable private company in America. This sudden jump caught the financial and tech world by surprise — not through a flashy IPO, but via a carefully planned

$1 billion share sale that included both new funding and employee equity redemption. Backed by the explosive growth of Starlink and the bold future of Starship, this milestone isn’t just about numbers — it’s a sign of how Elon Musk’s space empire is reshaping the private aerospace industry.

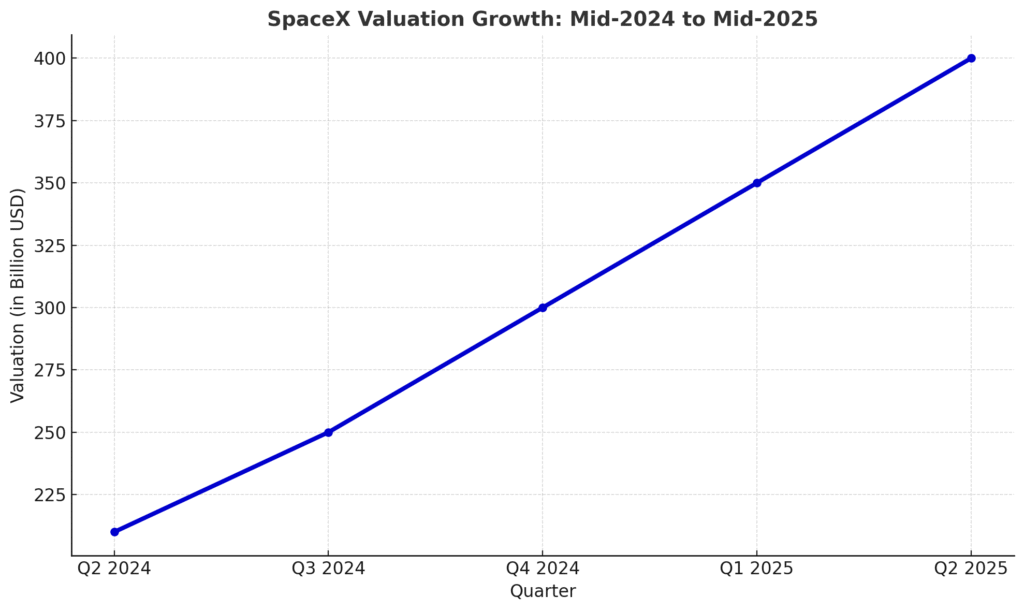

The Silent Rise: From $210B to $400B in 12 Months

In just one year, SpaceX’s valuation nearly doubled from $210 billion to $400 billion — and it happened with very little media noise. This rise wasn’t driven by hype or

main web site spacex.com

but by real market confidence, growing revenues, and massive progress in satellite deployment and reusable rocket launches. While many private companies struggle to hold value, SpaceX quietly built momentum through internal growth, product delivery, and long-term investor trust. No IPO, no Wall Street parade — just calculated moves and powerful results.

WhatTriggered the $400 Billion Valuation in 2025?

In mid-2025, SpaceX quietly raised $1 billion through a mix of primary funding and secondary share sales. This allowed early investors and employees to sell their shares while also bringing in new capital.

The sharp rise to a $400 billion valuation was driven mainly by Starlink’s fast-growing revenue and the rising investor confidence in Starship’s future launches. Without an IPO or major PR push, SpaceX proved it could grow silently — and massively.

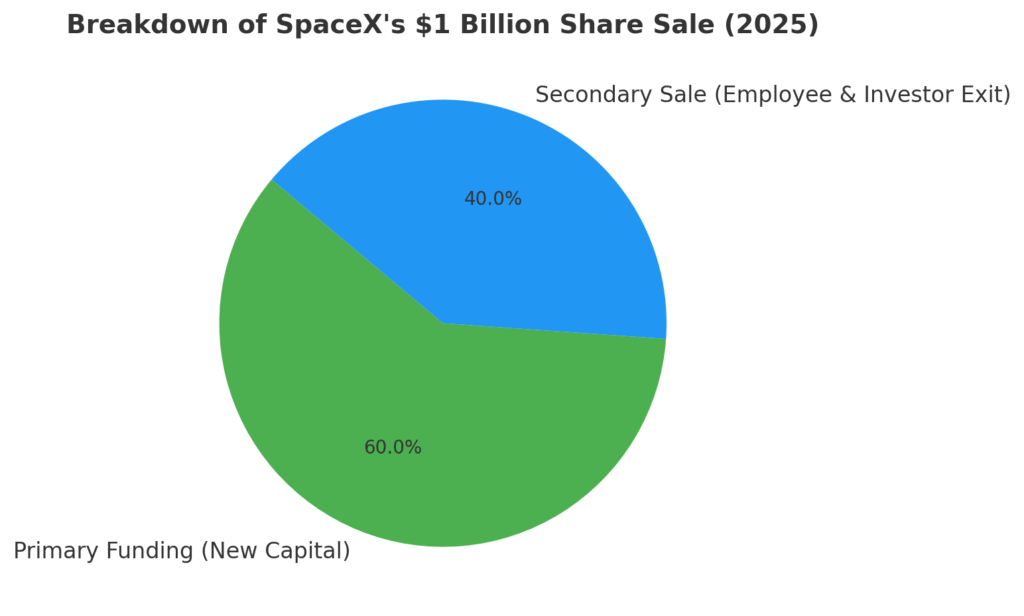

The Latest $1 Billion Share Sale Explained

In 2025, SpaceX opened a $1 billion share sale, split between primary investment (60%) and secondary sales (40%). The primary portion brought in fresh funds to support Starlink and Starship growth, while the secondary allowed employees and early investors to cash out at premium value.

Unlike IPOs, this move was private, targeted, and efficient — proving SpaceX doesn’t need public markets to grow or reward its people.

Starlink’s Role in SpaceX’s Financial Surge

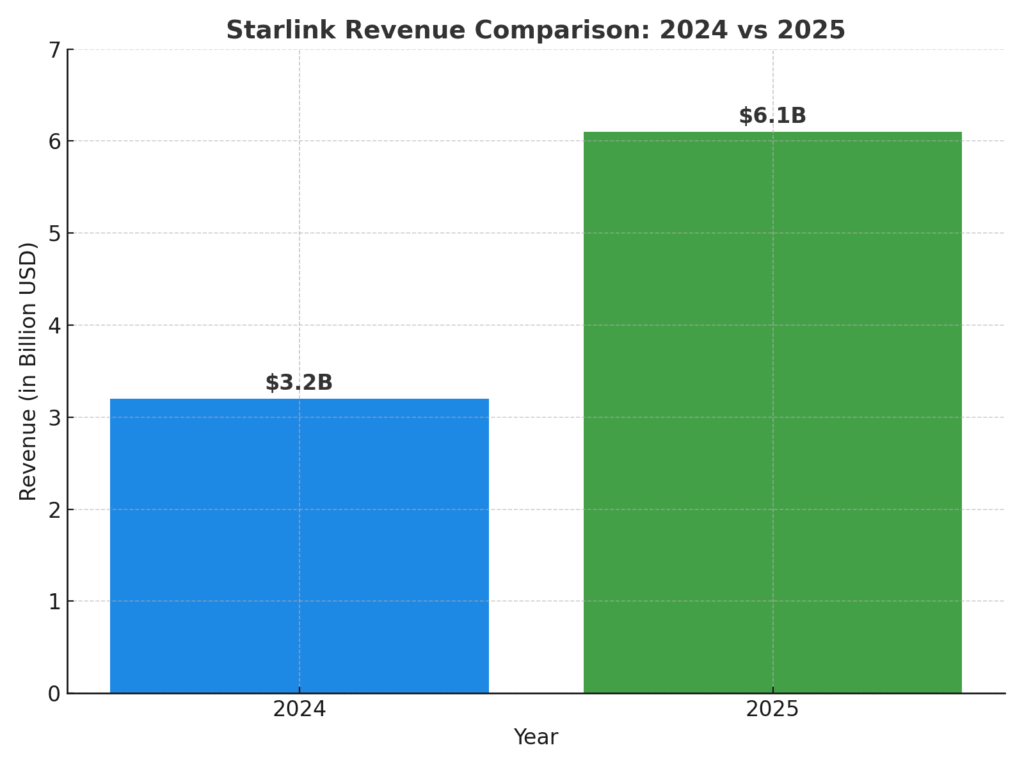

One of the biggest reasons behind the space company’s massive $400 billion valuation is the explosive rise of Starlink. The satellite internet service is now active in over 70 countries, with millions of users worldwide. In 2025 alone, Starlink is estimated to bring in over $6 billion in revenue, making it the company’s top commercial arm.

From rural internet access to defense communication contracts, Starlink has quietly transformed the space company into a global internet infrastructure powerhouse. Investors now view Starlink not as a side project — but as the financial backbone of the entire operation.

Starlink Revenue Growth in 2024–2025

- Starlink’s revenue grew rapidly from $3.2 billion in 2024 to an estimated $6.1 billion in 2025, nearly doubling in just one year. This growth came from rising global subscriptions, new government deals, and better service coverage.

Starlink Revenue Growth in 2024–2025

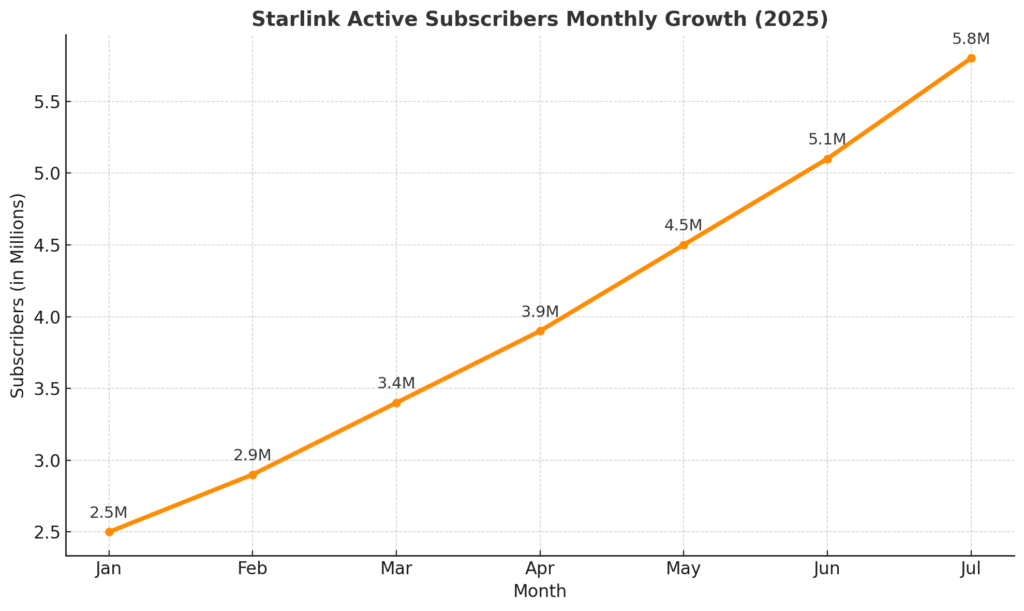

Satellite Deployment and Subscriber Boom

Starship’s Impact on Investor Confidence

The successful progress of Starship, the space company’s next-gen super heavy-lift rocket, has become a key driver of investor confidence. Designed for deep space missions and bulk cargo delivery, Starship represents not just ambition — but execution.

With multiple test flights showing steady improvement and upcoming plans for lunar and Mars cargo missions, investors now see Starship as the long-term growth engine. It signals that the company isn’t just building rockets — it’s building the future of space logistics.

Successful Launches vs Failures (2023–2025)

Between 2023 and 2025, the space company conducted several high-stakes Starship test flights. While early trials saw some failures, recent missions showed significant improvement. Out of the latest 8 launches, 5 were successful, 2 had partial success, and only 1 failed — a sign that the system is maturing fast and building

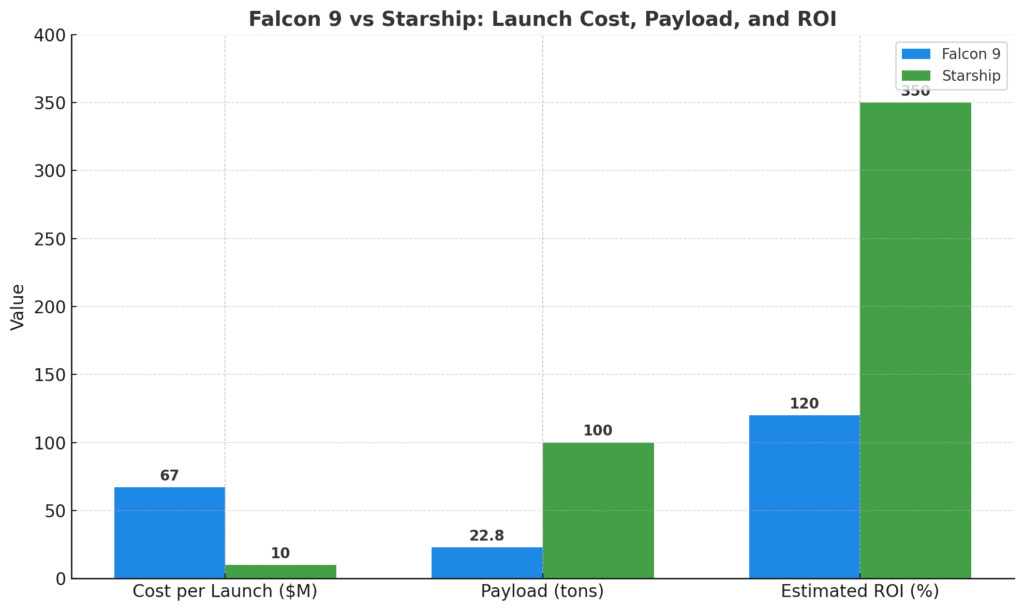

Starship vs Falcon 9: Which One Drives More Value?

Falcon 9 has been the company’s workhorse, flying over 500 times with an unmatched reusability record. It’s efficient, affordable, and reliable — ideal for satellite deployments and cargo missions. But in terms of long-term value, Starship is being viewed as the bigger game-changer.

Unlike Falcon 9, Starship is designed for deep space travel, lunar cargo, and Mars missions. Its ability to carry over 100 tons of payload — 5 times more than Falcon 9 — gives it a massive economic edge for the future. While Falcon 9 dominates today, Starship is the key to unlocking multi-billion dollar opportunities in the decade ahead.

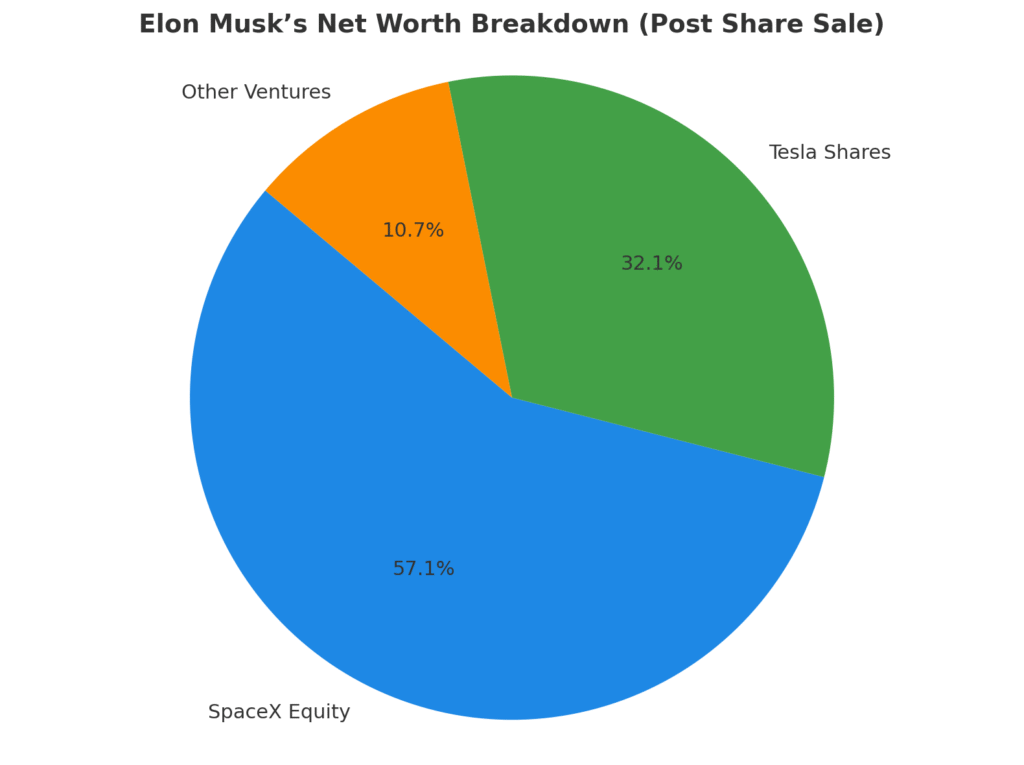

Elon Musk’s Stake & Net Worth Jump

The recent share sale didn’t just boost the company’s valuation — it catapulted Elon Musk’s personal net worth as well. With an estimated 40% stake still intact after the sale, Musk’s equity alone in the space company now accounts for over $160 billion.

This jump has pushed him even further up the global billionaire charts. But more than money, it reflects how closely Musk’s fortune is tied to the company’s growth. As Starlink expands and Starship gets closer to commercial missions, investors now see Musk’s stake not just as ownership — but as a bet on the future of space.

Musk’s 40% Ownership Explained

Despite multiple funding rounds, Elon Musk has managed to retain around 40% ownership in the company — a rare feat for any founder. This gives him not just voting power, but strategic control over the company’s future. With the latest $400 billion valuation, Musk’s stake alone is now worth more than the GDP of many countries.

His tight grip also reassures investors that the company’s long-term vision — Mars, Starlink expansion, and interplanetary logistics — won’t get diluted by boardroom politics.

Net Worth Before vs After Share Sale

Before the latest funding round, Elon Musk’s net worth was already hovering around $200 billion, with most of it tied up in Tesla and his private holdings in the space company. But after the $400 billion valuation, his 40% stake alone added nearly $80 billion more to his wealth.

Now estimated at $280 billion, Musk is not just one of the richest people alive — he’s the only one whose net worth is driven more by spacex innovation than by traditional industries.

Will This Lead to a SpaceX IPO Soon?

With a $400 billion valuation, many market analysts believe an IPO (Initial Public Offering) could be just around the corner. The latest share sale shows strong investor appetite, and the company now has the financial maturity, global infrastructure, and revenue streams (like Starlink) that public markets look for.

However, Elon Musk has repeatedly stated that he’s in no rush to go public, citing reasons like mission focus and avoiding short-term market pressure. Still, as the firm grows bigger than most public companies, the question remains — how long can they avoid Wall Street?

Conclusion – A Turning Point in Space Industry History

The jump to a $400 billion valuation isn’t just a win for one private company — it marks a seismic shift in the spacex industry. For decades, space was seen as the domain of governments and billion-dollar budgets. But now, private players are rewriting the rules — launching satellites, building internet infrastructure, and even planning human missions to Mars.

This isn’t just about rockets anymore. It’s about creating a new spacex economy — one driven by innovation, commercial potential, and bold long-term vision. Whether or not an IPO happens, one thing is clear:

We’re entering a new chapter in space history — and it’s being led by entrepreneurs, not agencies.

note

This blog is not written by AI.

Every section you read here is based on deep manual research, real-time analysis, and crafted to deliver value — not generic fluff. We believe in authentic, human-written space content that goes beyond clickbait.